OpenAI has emerged as a kingmaker in the AI economy, with investors rewarding companies that secure partnerships with the ChatGPT creator. The pattern extends beyond semiconductor firms.

Just last week, shares of Etsy closed up nearly 16% after OpenAI announced ChatGPT Instant Checkout for the shopping site. Shopify’s stock closed up more than 6% on the same news. Etsy pops 16% as OpenAI announces ChatGPT Instant Checkout for the shopping site The feature allows U.S. ChatGPT users to purchase directly from merchants without leaving the conversation interface.

This market-moving influence typically belongs to companies like Apple or Nvidia. OpenAI’s ability to significantly impact stock valuations across diverse sectors—from semiconductors to e-commerce—reflects its central position in the AI revolution. The company’s $500 billion valuation, achieved through a recent $6.6 billion secondary share sale involving current and former employees, makes it the world’s most valuable private company, surpassing SpaceX.

Background and related coverage: AI model accuracy research, custom chips and supply, Sora 2 app, Study Mode, hardware design deal, CoreWeave agreement.

Milestones

The AMD Instinct MI450 series will be the first GPU generation in this multi-year deployment, with specific technical specifications yet to be publicly detailed. AMD’s Instinct line competes directly with Nvidia’s data center GPUs, targeting high-performance computing and AI training workloads that require massive parallel processing capabilities.

The 6-gigawatt is a extraordinary scale in data center terms. Approximately enough power to serve 1.2 million homes, channeled instead into AI computation infrastructure. OpenAI’s deployment timeline extending through 2030 allows AMD to develop future Instinct generations specifically optimized for OpenAI’s evolving model architectures and training requirements.

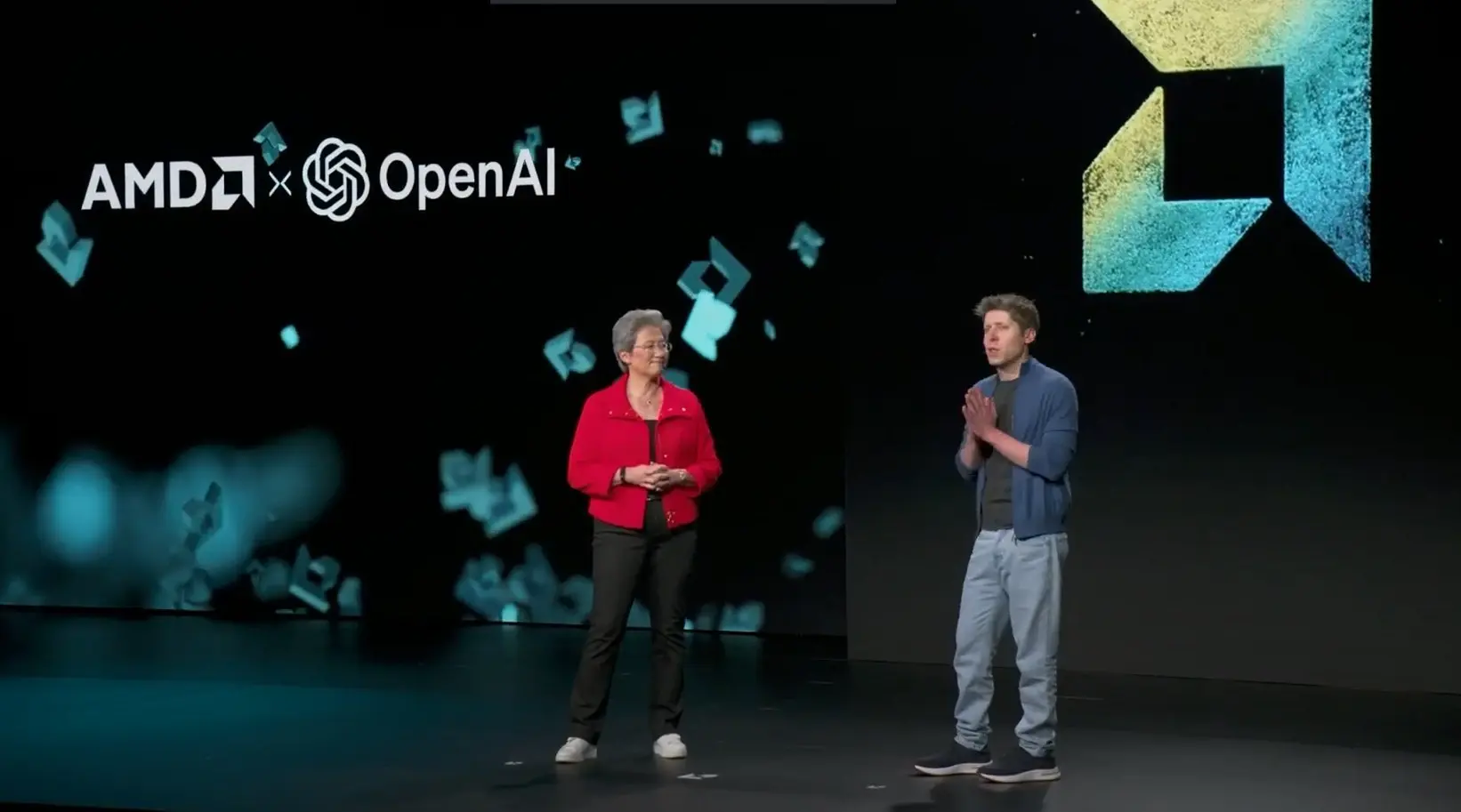

The partnership creates “strategic alignment and shareholder value for both AMD and OpenAI,” AMD and OpenAI , according to AMD’s official statement.

Conclusion: The AMD-OpenAI partnership announcement covered the definitive agreement for 6-gigawatt GPU deployment, the warrant structure providing OpenAI with up to 160 million AMD shares, and the initial 1-gigawatt MI450 deployment timeline beginning in the second half of 2026. The article detailed AMD’s 24% stock surge on October 6, 2025, representing the company’s largest single-day gain in nearly a decade. Coverage included the multi-generational collaboration history between AMD and OpenAI, the financial projections of tens of billions in revenue for AMD, and the milestone-based vesting structure tied to deployment scale and share-price targets. The piece discussed OpenAI’s $500 billion valuation as the world’s most valuable private company and examined the company’s market-moving influence across multiple industries. Technical specifications of the AMD Instinct MI450 series and the broader context of OpenAI’s multi-vendor infrastructure strategy were addressed. Official details AMD and OpenAI.