In a surprising turn of events, shares of Dutch semiconductor equipment maker ASML Holding NV (ASML-NL) plummeted by a staggering 16% on Tuesday after the company prematurely published financial results containing disappointing sales forecasts for 2025. The caused ripple effect was felt throughout the chip industry, with giants like Nvidia (NVDA) and Advanced Micro Devices (AMD) also taking a hit in the aftermath.

Technical Error Flattering the Vulnerability

ASML attributed the premature release of its earnings report to a technical error that inadvertently published the document on a section of its website. “We expect our 2025 total net sales to grow to a range between 30-35 billion euros, which is the lower half of the range,” says Christophe Fouquet, CEO of ASML, addressing the disappointing forecast in the earnings release.

One of the key indicators of ASML’s weaker-than-anticipated performance was its net bookings for the September quarter, which amounted to a mere 2.6 billion euros ($2.83 billion). This figure fell significantly short of the consensus estimate, which ranged between 4 and 6 billion euros. On a positive note, the company’s net sales managed to surpass expectations, reaching 7.5 billion euros.

Similar Posts:

China Concerns and Expectation of Gradual Recovery

The company also faces challenges in China due to U.S. and Dutch export restrictions on shipments of critical technologies, including advanced chipmaking tools. Roger Dassen, CFO of ASML, expects the company’s China business to normalise, with China accounting for approximately 20% of its total revenue in the upcoming year. This marks a significant shift from the June-quarter earnings presentation, where ASML reported that 49% of its sales originated from China.

However, analysts suggest that it is companies “overcapacity at chip factories rather than a slowdown in global semiconductor demand” is the reason for underperformance. The production could have been boosted by efficient use of ASML’s expensive tools, which weren’t inventoried well post pandemic.

Implications for the Chip Industry

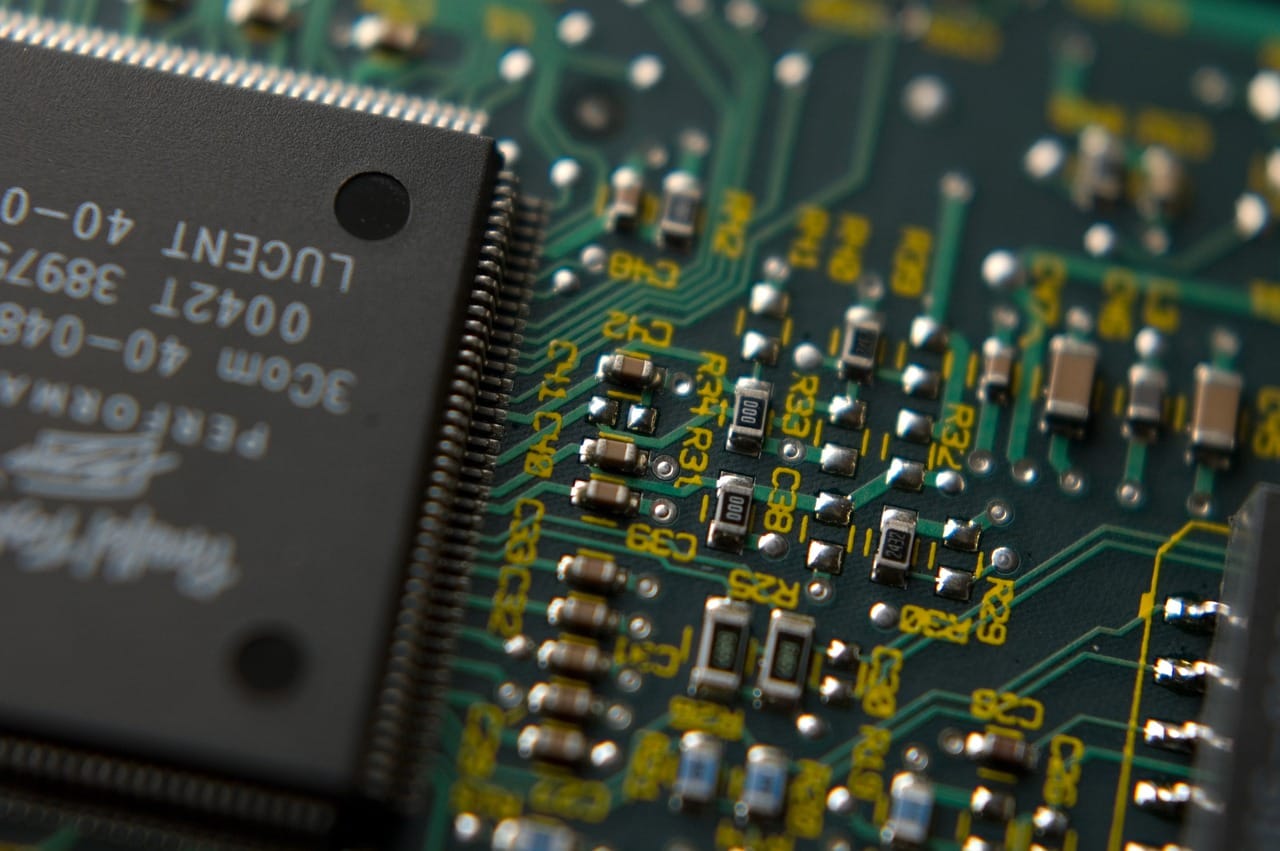

ASML’s extreme ultraviolet lithography machines are essential to many of the world’s largest chipmakers, including Nvidia and Taiwan Semiconductor Manufacturing, for the production of advanced chips. The company’s revised guidance and the subsequent market reaction underscore the interdependence within the semiconductor industry and the potential ripple effects of a single company’s performance on the broader sector.

As the chip industry grapples with the implications of ASML’s disappointing forecast, it remains to be seen how companies will adapt their strategies to navigate the challenges posed by slower-than-expected recovery in certain market segments and the ongoing export restrictions in China. The coming months will be crucial in determining the resilience and adaptability of the semiconductor industry in the face of these headwinds.