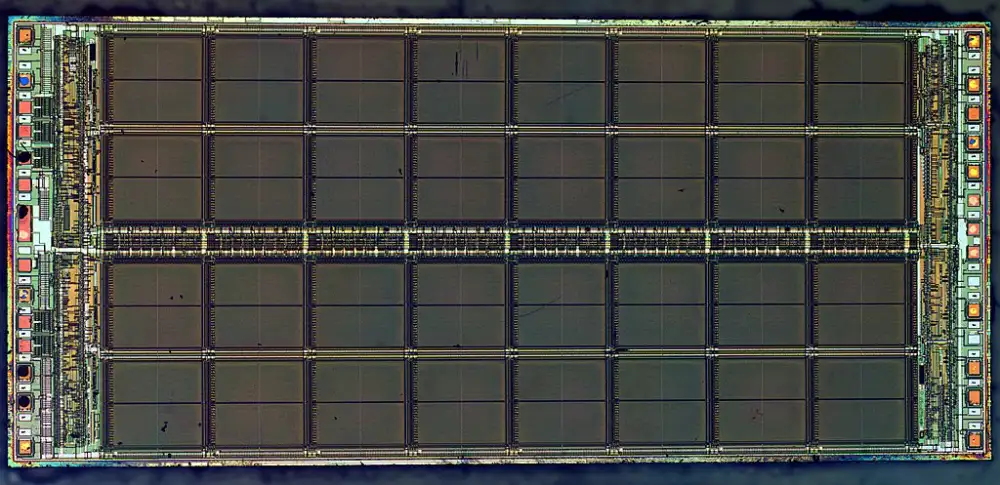

The memory chip shortage stems from a fundamental shift in production priorities. Major DRAM manufacturers including Samsung, SK Hynix, and Micron are reallocating fabrication capacity toward High Bandwidth Memory (HBM) chips required for AI accelerators like Nvidia’s B300 and custom chips from cloud giants.

According to TrendForce’s market analysis, NAND demand in 2026 is expected to grow 20-22% year-over-year, while supply will increase only 15-17%, creating an inevitable supply-demand gap. The firm has downgraded its 2026 notebook shipment forecast from 1.7% growth to a 2.4% decline due to rising component costs.

Team Group’s general manager Gerry Chen warned that December contract prices for DRAM and NAND increased 80-100% month-over-month, with availability expected to worsen in Q1-Q2 2026 once distribution stockpiles are exhausted.

AI-driven demand for High Bandwidth Memory has triggered unprecedented price increases across all memory types, forcing PC manufacturers, smartphone makers, and data center operators to navigate the most severe supply shortage since 2020.

Crisis By The Numbers

💰 Calculate Your Device Cost Impact

Crisis Timeline: How We Got Here

Price Trajectory Analysis

Industry-Wide Impact

Understanding the Root Causes

Building new fabrication facilities takes at least three years. Even if manufacturers decided today to construct new memory fabs, they would come online in late 2028 at the earliest and reach full production only in 2029, meaning relief is years away.

For consumers and businesses planning technology purchases, prices will remain elevated through 2026 and likely into 2027. Strategic planning and early procurement are essential for managing these cost pressures.

Related Coverage:

Micron Kills Crucial Brand After 29 Years as AI Memory Demand Swallows Capacity

iOS 26.2 December 2025: Urgent Updates for Reminders, Alarms, and CarPlay

Android 16 QPR2 December 2025 Update

Discord Checkpoint 2025: 744 Billion Messages Year Review

Snapchat Recap 2025: Voice Calls Surge 30 Percent

Industry Analysis:

Expert commentary on social media platforms highlights the unprecedented nature of this crisis and its long-term implications for technology pricing.

The coverage examined memory chip pricing pressures affecting PC manufacturers, smartphone makers, and data center operators during the 2025-2026 period. The discussion included contract price data from major suppliers and shipment forecast revisions from industry analysts.

Topics addressed included capacity reallocation decisions by Samsung, SK Hynix, and Micron; commercial pricing adjustments announced by Dell and Lenovo; and supply timeline estimates from component manufacturers. The material presented DRAM spot price movements, NAND supply-demand projections, and fabrication expansion schedules.